Taxes that come out of paycheck

Make Your Payroll Effortless and Focus on What really Matters. Any income exceeding that amount will not be taxed.

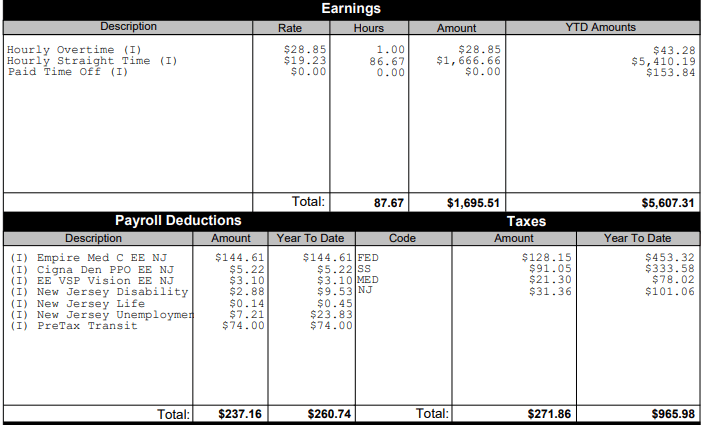

What Are Payroll Deductions Article

Simplify Your Day-to-Day With The Best Payroll Services.

. Ad Compare 5 Best Payroll Services Find the Best Rates. FICA taxes are Medicare and Social Security taxes and they are withheld at rates of 145 and 62 of your wages respectively. The state tax year is also 12 months but it differs from state to state.

Ad Choose From the Best Paycheck Companies Tailored To Your Needs. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. You pay the tax on only the first 147000 of your earnings in 2022.

If no federal income tax was withheld from your paycheck the reason might be quite simple. Whether to withhold at the single rate or married rate. Louis or Kansas City you will also see local income taxes coming out of your wages.

If you earn over 200000 youll also pay a 09 Medicare surtax. Similar to the tax year federal income tax rates are different from each state. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

There are seven tax brackets in 2020. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. The information you give your employer on Form W-4 and DE 4 if desired.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Estimate your federal income tax withholding.

See how your refund take-home pay or tax due are affected by withholding amount. Some states follow the federal tax year some states start on July 01 and end on Jun 30. The states tax rate is 081 percent which is lower than the national average of 107 percent.

In Indiana the average yearly property tax bill is 1263 which is much lower than the national average of 2578. The amount of income tax your employer withholds from your regular pay depends on two things. You should also note that you can deduct up to 60 of your propertys assessed value up to a maximum of 45000 if you are a.

IR-2019-178 Get Ready for Taxes. These are contributions that you make before any taxes are withheld from your paycheck. Form W-4 includes three types of information that your employer will use to figure your withholding.

America uses a progressive system in determining what employees pay in income tax. According to some changes in the W-4 Employee Withholding Certificate find out more about that here earnings that are too low might not have their income taxes withheld at all. This means that the amount required by the government is smaller for those who earn less.

These are 0 12 22 24 32 35 and 37. You didnt earn enough money for any tax to be withheld. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount.

While this does represent a progressive tax system the income tax rates. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. If you live in St.

Choose an estimated withholding amount that works for you. Use this tool to. Get ready today to.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Unlike Social Security Medicare is fully taxed on all of your income and if your earnings exceed 200000 youll pay an.

Your employer matches these contributions so the total FICA contributions are double what you pay. How It Works. The amount you earn.

Combined the FICA tax rate is 153 of the employees wages.

Different Types Of Payroll Deductions Gusto

Paycheck Taxes Federal State Local Withholding H R Block

Irs New Tax Withholding Tables

Pay Stub Stumped Find Out How To Read Your Pay Stub

Understanding Your Paycheck

Tax Information Career Training Usa Interexchange

What Are Employer Taxes And Employee Taxes Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Take Home Pay Calculator

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck Credit Com

How To Calculate Payroll Taxes Methods Examples More

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time